How to invest in NFT’s, according to data

How to

invest in NFT's, according to data.

- What we learned after 6.1 million NFT Trades

- The biggest misconception about NFT is that they live permanently in a blockchain.

- How to value the six different kinds of NFT's available today.

- The problem of making big money on NFT's is that they are illiquid.

- What's the best strategy according to data to trade NFT's?

Introduction:

"The top 10% of traders alone perform 85% of all transactions and trade at least once 97% of all assets." – nature.com

I'd been researching NFT's seriously for more

than two months straight, from coding to paid newsletters, from interviews to

research papers. I wanted to understand NFT's as an investment. What I found is

fascinating.

I'll start showing you data from a recent

research paper analyzing over 6.1 million NFT trades. Then I'll explain to you

the biggest misconception about NFT's. I'll classify them into six categories

to later propose a way to value each since they are different in concept. I'll

explain the problems and possible solutions of what to do when you make much

money in NFT's. Finally, I'll give you my opinion on the best places to focus on

making money in this industry.

What is an NFT?

"… is a unit of data stored on a blockchain that certifies a digital asset to be unique and therefore not interchangeable, while offering a unique digital certificate of ownership for the NFT" - Evans

There's no need for me to explain what an

NFT is; after all, you could google it; however, it is very likely you don't

know the major misconception about them: That they are indestructible.

The major misconception about NFTs I

found:

The major misconception about NFTs is that

they are engraved in the blockchain. That's not the case for most of them. It

would be too big and expensive. Instead, what is done is to host the content in

IPFS, a peer-to-peer (p2p) storage network. Content is accessible through

peers located anywhere globally, which might relay information, store it, or do

both. IPFS knows how to find what you ask for using its content address rather

than its location.

This means that it is centralized wherever

you bought your NFT since they must maintain it. If those servers fail, your

NFT's are gone.

What we learned from

6.1 million NFT trades.

I came across this research of over 6.1

million trades of 4.7 million NFTs: https://www.nature.com/articles/s41598-021-00053-8#MOESM1

The main points I saw are:

- ·

This paper shows that 10% of NFT traders

accounted for 85%+ transactions. Could these be "spoof trades"

trading with themselves in 2 different accounts?

- ·

" We observe that the average sale

price of NFTs is lower than 15 dollars for 75% of the assets, and larger than

1594 dollars, for 1% of the assets...only ∼20% of them had a secondary sale, only 0.07% of all assets are sold more

than ten times."

- ·

"We find that NFTs in small

collections tend to be bought in sequence with NFTs in other collections (see

Fig. 4e). On the contrary, NFTs in large collections, like CryptoKitties or

Gods-Unchained, tend to be bought in sequence with NFTs in the same

collection."

NFT's classification:

1. Art

2. Collectible

3. Games

4. Metaverse

5. Other, and

6. Utility

I must mention that there will be more

categories as the industry evolves. I recently read of an NFT used to open

doors like a code. So "the sky is the limit." Also, the popularity of

this category varies a lot, depending on the year.

How do we value each category?

Valuing art,

collectives and some metaverse NFT's:

As far as art, collectibles, and most

cases of the metaverse. They behave a lot like fine art in the physical world. Here is a 5-minute refresher of how the

art business work

These are 4 "tricks" you must be

mindful of when entering into the NFT markets that resemble the Fine Art

industry:

1. Sell or give it to elites NFT social media influencers, hoping to be seen as a better brand, so the rest of the paintings or, in this case, NFT's could be worth more.

"Traders are also specialized: measuring how individuals distribute their trades across collections, we find that traders perform at least 73% of their transactions in their top collection, while at least 82% in their top two collections combined."

These "specialized NFT traders" resemble art galleries.

2. "Chandelier bidding" in art gallery auctions are equivalent to NFT "spoof trades," where traders trade with themselves in 2 different accounts that they own. This is supported by the data mentioned in the study above. It turns out that NFT traders are very specialized in one or two collections

"We find that NFTs in small collections tend to be bought in sequence with NFTs in other collections…On the contrary, NFTs in large collections, like CryptoKitties or Gods-Unchained, tend to be bought in sequence with NFTs in the same collection."

3. Launder money.

4. Tax write-offs through donations.

Donate NFT's tax

write-off?

One of the areas Id haven't seen much written about is donating NFt's as

tax write-off.

The Irs has no official guidance on NFT's yet. However, from

conversations with accountants in the niche

is widely accepted that they are likely to be treated as collectibles

under Irs code 408 (m)(2):

"(1) In

general. The acquisition by an individual retirement account or by an

individually directed

account under a

plan described in section 401(a) of any collectible shall be treated (for

purposes

of this section

and section 402) as a distribution from such account in an amount equal to the

cost to such

account of such collectible.

(2) (2)

Collectible defined. For purposes of this subsection, the term

"collectible" means—

(A) any work of art,

(B) ..."

The taxation of Nft's will significantly

depend on how you interact with them 1) creator or 2) investor.

Remember that NFT and crypto like ETH are

treated as property and are taxed according to your holding

period (short term vs. long term capital

gains). If you sell your Nft's, they would be subject to ordinary

income tax.

High-income earning individuals face a 28%

collectible tax + 3.8 net investment income tax vs. 20% long-

term capital gains.

Valuing Games NFT's

How to value games?

I must admit this is outside my circle of

competence. All I can imagine is that it depends on the popularity of the game and

its uses. I can also say that these uses will change fast as the industry

develops, and you may be able to migrate these features between different

games.

Valuing Metaverse NFT's

Metaverse is developing and can have more

sophisticated cases that resemble the real world. Now you can buy virtual real

estate in the metaverse, and you can make it produce as you would property in

the real world: Farming, building a house, a business, using it for publicity,

etc.

Remember that $69M digital collage

NFT sold in March 2021? It was produced by Mike Winkelmann, who goes by

Beeple; it sparked a global frenzy for non-fungible tokens. The guy that bought

is Indian entrepreneur Vignesh Sundaresan, a bitcoin billionaire that initially

invested $5000 in bitcoin. He plans to create a museum in the metaverse where

he will charge for entry. That's how he justifies the price.

Source: https://www.wionews.com/technology/vignesh-sundaresan-buys-nft-for-69-million-people-can-download-it-for-free-433242

The metaverse is developing so fast that there are

already virtual real estate companies to develop and manage your virtual real

estate like https://metaverse.properties/

" Ultimately,

we see Metaverse Group as being a significant landowner and developer in the

digital world with the ability to pay out distributions in a REIT structure…

This also makes Tokens.com one of the first public companies in the world to

have exposure to the Metaverse"...CEO Andrew Kiguel of Tokens.com

Valuing UTILITY and Others NFT's

Utility NFT's are NFT's that

have another purpose. This is more likely to be valued rationally.

For example, you can buy an

NFT that would allow you to get into certain event once a year.

This is exactly what social

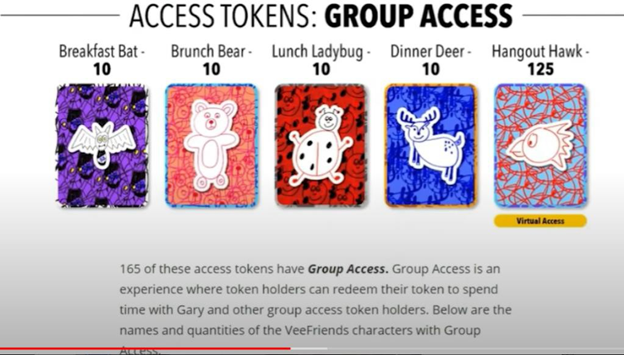

media influencer Gary Vee did.

"..in The last 90

days I've done 91 million dollars in revenue on my "v friends nft"

launch the first 51 million I kept which was in one week, then the next 40 I've

gotten a 10% royalty on every transaction last night while I was sleeping and

made $246,000 on the royalties of people selling my NFt's to each other…"

– Gary Vee

Gary Vee

launched https://veefriends.com/ with https://www.nft42.com/ (owned by Mark Cuban). Those Nft's come with other benefits, real-world use cases.

Look at the "current floor price."

The cheapest

one, below, is $31,247.61, and he made thousands! https://opensea.io/assets/0xa3aee8bce55beea1951ef834b99f3ac60d1abeeb/9180

Why are they so successful? Look at the description: "This token is verifiable for admission to VeeCon 2022, 2023, 2024."

You get the point;

they give access

to content creators and brands on a whole different level.

How we value

them depends on how you will value the underlying Utility or benefits it gives

you the right to.

The problem of making much money in

NFT's: Illiquidity.

One of the report findings is that the NFT

market has very low liquidity. It can be challenging to find a buyer for your

NFT. This indicates that the "floor price" of the NFT is not an

indicator of value.

Id identified only four options once

somebody finds themselves in this situation:

A)

You can wait to see if they

come back again (unlikely, according

to data)

B) Try to sell 10% of the portfolio

by lowering prices until you can liquidate and get the initial investment out.

C)

Try to borrow against

it using it as collateral. There are new companies doing

this.

D)

Use it for

a tax write-off

Is there a way to make money in NFT

consistently?

I'll mention the obvious low-hanging fruit

first. If you are a social media influencer and offer utility NFT's that create

much value for your followers, you can make it happen. And nowadays you can

sell those at a premium.

If you don't have a following to sell your

own NFT's, your odds fall drastically.

"We observe that the average sale price of NFTs is lower than 15

dollars for 75% of the assets, and larger than 1594 dollars

for 1% of the assets. Considering individual categories, NFTs

categorized as Art, Metaverse, and Utility reached higher

prices compared to other categories, with the top 1% of assets having

average sale price higher than 6290, 9485, and 12,756 dollars respectively…

Note that only 0.07% of all assets are sold more than 10 times."

– nature.com

As you can see, odds are not in your favor.

Especially if you think you can trade an NFT multiple times. However, the

research found a good correlation in a strategy: look for a project with a

big following that sold very well a week prior and has something visually

different, thank most NFT's.

"..The

prior probability of sale in the collection is also a strong signal, and

centrality and visual features combined can sometimes outperform other feature

combinations (e.g., in the Metaverse category)."

Keep in mind that these NFTs are the

minority. Less than 10% are sold within one week after the primary sale, and

only 22% are sold within one year.

"NFT's price correlates strongly with the price of NFTs previously

sold within the same collection (see "SI"). The median sale price of NFTs in

the collection predicts more than half of the variance of price of future

primary and secondary sales – nature.com

The research above also mentions that the

best time window to review the primary sell time is one week. The longer you

wait, the worst it is. This is an example where time is not your friend.

" visual features of the object linked to the NFT … explain roughly one-fifth to one-fourth of the variance …When considered in combination with the median price of previous sales, they increase the predictive power" – nature.com

In simple terms, this means that the way they measure how unique the image was could explain 1/5 to ¼ of the price variation.

"it becomes apparent that the predictability of future prices and the predictive power of different sets of features varies depending on the NFT category. The collectible category is the easiest to predict, with centrality and visual features" – nature.com

As I exposed before, each category

requires a different valuation methodology. But collectibles seem to be the

easiest to predict with this formula.

Final comments about this study to keep in

mind: it runs from June 23, 2017, and April 27, 2021, where they considered

mostly the Ethereum and WAX blockchains, but several other platforms offer

smart contracts and NFTs. They did not include information about the creator of

the (digital) object associated with the NFTs that, in my opinion, has a huge

impact and is maybe a good parameter of predictability to trade NFT's.

Conclusion

Based on a recent research paper running

from June 23, 2017, and April 27, 2021, that analyzed over 6.1 million NFT's

trades, I had been able to understand the economy of the NFT world a little

better, the odds and strategies of trading in it successfully.

I explain to you the biggest misconception

about NFT's indestructibility.

By classifying them into six categories,

we could describe how to value them more efficiently.

I analyzed the illiquidity problems of the

NFT world and theories of what could be done when you find yourself in them.

Finally, I explained that the best

strategy that the researchers describe is to buy popular NFT's within the first

week of launch, especially if they look unique than most NFT's