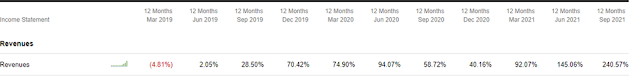

VOXTUR – 500% growth in 2022/2023.

- · Triple-digit growth, year after year. With a lot of runway still to come. Expected margins will increase to 75% by mid-2023.

- · Trading at 1.5 P/S 2022 estimates when similar companies trade at 20x multiples.

- · What is the street missing? Growth is mispriced because they trade in the TSX Exchange, and the company is hard to understand. The catalyst is that they are moving to Nasdaq next year.

Investment Thesis

We'll analyze Voxtur

and why I think it is mispriced through this article. I'll argue that it

deserves a much better valuation once you can put the multiple moving parts of

mergers and acquisitions in context.

Voxtur trades in the TSX

Venture exchange witch is ignored by most investors, creating an opportunity

due to the lack of popularity on the stock. This is why Management plans to

list on Nasdaq in the next couple of quarters. This would bring more eyes and

popularity to this stock, which deserves a much higher valuation.

The opportunity comes

because the short-term growth is currently mispriced due to a lack of

understanding of the company's growth sustainability.

https://app.hubspot.com/documents/19575479/view/260355706?accessId=2c4da7

What is Voxtur?

"One-stop shop for efficient access to

real estate data and the entire real estate process."

"With

the largest verified database in real estate, our workflow platforms

efficiently appraise assets, originate and service loans, securitize

portfolios, and evaluate tax assessments with verifiable proof. " - https://www.voxtur.com/

Originally started and

listed in Canada, over 90% of their revenues are now generated in the U.S.

What does Voxtur do:

Voxtur can be better

explained in the context of 4 different macro services inside the real estate

industry. Here they are with a summary of their competitive advantage:

1.

Valuation

of real estate properties. They

have a product that can make appraisals

20% cheaper in half of the time.

2.

Tax

Assessment. They access more

than 65% of U.S. tax collectors in a database, allowing them to create and sell

a $20 service to homeowners directly to analyze if their taxes are high or low

compared to other comparable properties.

3.

Settlement

services – Tittle, closing, title insurance. With the development of automated and instant "Attorney Opinion

Letters" Voxtur can create a cheap alternative to title insurance based on

their proprietary data. They can bring the cost from $1500 down to $250 and

keep 70% margins.

4.

Data

insights. Important for future

product developments. Notice that Voxtur is not a SAAS but a DAAS (data as a

service) with better business economics. But for simplification of this report,

I'll refer to it as a SAAS.

"Once we've got all of these

platforms that we own and built, each business is a minimum of a half a billion

dollars… as far as revenue, each! "- Gary Yeoman

I'll develop these

points later in depth. First, we need to understand Voxtur history.

Summary of Voxtur history:

It all

starts with Gary Yeoman, current executive chair. Is the founder and former CEO of Altus Group

(TSX: AIF), a real estate software, data, and analytics company. He has a deep

domain expertise in building a similar multinational.

He partnered

with Bank of Montreal for funding to finance acquisitions. For this negotiation

not only did the bank get to make the loans but they also invested in the

company and are the sponsor's for Voxtur to list in Nasdaq.

Once

the funding was in place Gary goes out and starts buying and merging

strategically with companies for:

·

Their

existing revenue

·

Their

licenses and clients

·

To

cross-sell similar non-competing products to the same clients.

·

To create

a "One-stop shop for efficient access to real estate data and the entire

real estate process."

Management has stated

that every merger or acquisition must be in real estate technology,

synergistic, create value, and accept cash and stock as payment.

What problem do they solve?

If you ever have

bought or sold a house, you know this:

You need a real estate

agent to promote it (not always), you want a professional appraisal to

determine what the house is worth for the bank loan, you need to pay the taxes,

look for the title and see that it is "clean" (meaning no-one is

suing you) and then you can transfer it.

For some reason, this

is a very inefficient procedure; it takes 30 to 90 days.

Voxtur is speeding all

that by putting data together of the companies it has acquired and substantially

lowering the cost.

Imagine that you go to

a fast-food restaurant to get a hamburger, to another one to get a coke, and

yet to another one to get potatoes. That's the real estate business for you in

a nutshell.

Here is Voxtur's road map:

Gary starts with

Ilookabout. An image database company. This is important because you want

updated pictures in appraisals fast to review the appraiser's work.

Then acquires

Clarocity Corporation. A provider of real estate valuation services through its

data and analytics capabilities. This also opens the door to cross-sell Freddie

Mac and Fannie Mae, saving years of pre-qualifications to Ilookabout to do

business with them.

The Apex acquisition

follows. This is the most popular sketching software for appraisers; they have a

presence in over 2100 counties. This becomes a strategic acquisition that also

allows for cross-selling different products.

Voxtur, originally a Title

business, was acquired, and Jim Albertelli became CEO.

Next comes the ANOW.com

acquisition. This is the appraisal side of the system, they charge a transactional

fee to the lender, and appraisers (AMC = appraisal manager companies) pay a

monthly fee.

They use the software

to validate that the images were taken by appraisers, inspectors, and even

owners coincide with images in their database.

They use machine

learning to match to analyze images with MLS data.

Next comes the Xomesolutions.com

acquisition, formerly owned by mrcooper.com, one of the top 5 mortgage

servicers in the U.S. Mr. Cooper couldn't offer the service to

competitors effectively until they made it independent.

Not only did they acquire

AMC clients (appraisal manager companies) with some of the top 10 lenders of

the U.S. They have also accumulated over 98.2% of all MLS data.

Most real estate

agents use MLS to get certain information and list properties. It is limited to

professionals only. I see it as a virtual monopoly in Us and Canada.

Notice that acquiring

Xome lowered the margins in the financial statements, but this is just

momentarily. Management expects margins of 60% by the end of 2022 and 70% to

75% hallway of 2023

Finally, the last acquisition

was Benutech, one of the largest real-time real estate data repositories in the

United States, enabling title professionals and real estate agents to access

real estate data from multiple public and private data sources.

Team (note: Management ownership is approximately 40%)

Understanding Voxtur 4 macro services

at a high level:

Voxtur has very

specific niches within the real estate industry in North America:

Presentation: https://app.hubspot.com/documents/19575479/view/260355706?accessId=2c4da7

And as we mentioned

before, these Macro services are categorized like this:

1.

Valuation

of real estate properties.

2.

Tax

Assessment.

3.

Settlement

services – Tittle, closing, title insurance.

4.

Data

insights.

Tax business:

Voxtur has focused on "b2g"

business-to-government in this niche. Governments, municipalities, counties,

provinces, states to provide analytical services on property tax, currently,

about 11 million dollars a year, to be about to be 15 million dollars a year

with a new contract that they're getting with the province of Ontario.

"In Ontario

alone, the government pays 75 million dollars a year just to fight assessment

appeals we can mitigate a good portion of that by enabling them to deliver

proper fair, equitable assessments and taxes…" - Gary Yeoman

There are two parts to

the assessment on property tax business:

1)

Provide

imagery, desktop valuation services, mobile applications to provide assessment

services to counties and municipalities.

2)

Provide

real property tax analytics. Use to confirm assessment or to create reports

with a predictive analytics tool to tell you whether your property taxes are

too high or too low and by how much. They are currently in 50 major cities and

gaining speed.

Market size: 150

million residential properties in the U.S. alone with margins north of 90% once

it's running at full force

They also serve b2b customers

within the tax services, like lenders.

"no one is

doing this …that we know of. Our

proprietary algorithms coupled with the data that we're getting… of the MLS

data from Mr. Cooper and Xome… core logics data that we're getting with the

acquisition of Benutech, that should close any day …we think that WE HAVE

THE MOST COMPREHENSIVE DATABASE YOU KNOW IN NORTH AMERICA. "– Gary

Yeoman

Valuation business:

"Our overall

goal is to fully populate those appraisal cards, to roll out an insurance

wrapper around those to guarantee the value to the lender. Today it takes 50

days versus the one a day they're doing now. "– Gary Yeoman

The technology that is

offered in today's appraisals business is almost non-existent.

In order for a bank to

apply for a mortgage, it costs eight hundred dollars and up to 20 days, and the

lender must get access to title insurance after that.

Anow.com is the only

fully digitized A.I. encrypted appraisal platform in North America. They just

landed their first major client with United Wholesale doing 70 000 transactions

a month.

Not only is this

platform five times quicker and cheaper. It is a business with 30% margins that

they expect to turn into a 70% margin business.

The appraisal market

alone is 4 billion. On top of that, Voxtur will get increased demand with

default, foreclosures, and refinancing once the governmental moratorium is

lifted.

Settlement services – Title, closing,

and title insurance.

As mentioned before.

Once the seller gets an appraisal and everyone is ready to register the title,

the buyer needs to get "title insurance." This insurance will cover the

cost if there are issues with the title in the future. And all of this is

needed because our legal system is archaic, and there could be pending lawsuits

that may not have been found in the "title search."

The average cost in

the U.S. is $1500. They can take it down in cost substantially. I'd heard they

would price this anywhere from $500 to $250. The Title businesses can have

margins between 45% to 55%, but with the improvements, they expect to take it

up to 60% by the end of 2022.

Data insights:

I won't develop much

on this point because I want to stick to facts. I want to mention that many of

these services are done by repurposing existing assets. In this aspect, Voxtur

resembles a "data-as-a-service" business model, which is better than

a "Software-as-a-Service." Daas companies have better economic than

Saas companies.

Their development cost

is strictly marketing and programming to test, develop and deploy new products

in their networks, easily done by cross-selling to existing clients in

different niches.

Valuation:

Management recently

mentioned that they have over 300 master services agreements already in place.

Their clients don't like to be used to promote other stocks, which makes sense,

so every time they get a new client, they don't come out with a press release. You

must remember this are big clients sometimes like Mr. Cooper, Fannie Mae, etc.

Only last month, investors in internet chatrooms found that United Wholesales

is one of the new customers; this is one of the 4 top lenders in the U.S. The

company never made a press announcement, so that you won't find it in your due

diligence.

The best way to value

a growing company in this stage is to use a fair multiple over revenues of

comparable SAAS companies with similar margins and growth.

I'll use as a starting

point a Valuation from iA Capital Markets. Notice that the valuation you are about to

see is, in my opinion, conservative.

When you look at these

numbers closely, please notice that Management commented about this same report

on an interview, saying

that they didn't think the revenue forecast here where high and that the

multiples assigned were still conservative. They trust they can do even better

than these projections.

Multiple on sales

Let me show you today's

market multiples of the five fastest-growing SAAS companies that I could find.

-

Bill.com

54x P/S, growth rate 151.9%

-

Snowflake

79.5x P/S, growth rate 109.5%

-

Sprout

social 11.1x P/S, growth rate 96.1%

-

Datadog

50.4x P/S, growth rate 74.9%%

-

Asana

34.4x P/S, growth rate 70.3%

Assuming a 10X P/S

multiple is conservative, in my opinion, because those are similar business

models to Voxtur. But they are not growing as fast; they are already too big.

I am considering 2022

Revenue estimates of $273M, which is in line with current management

projections.

That's a future market

cap of 2.73 billion vs. today's $500M. Or 546% higher.

$0.81 * 546% = $4.42/share

Conclusion

Voxtur has created

through Mergers and Acquisitions a series of products needed in the real estate

market. As they transition to Nasdaq in the next year, I suspect the market

will come to realize that their extraordinary growth and margins are

sustainable for some time to come. Giving them a more realistic multiple will

raise their valuation by five times higher than today.

If you are interested

in learning more, I suggest a video series explaining the company valuation by Mariusz Skonieczny.