Value Investing Fund, INC 1st Annual Letter 2019-2020

Value Investment Fund, INC. annual Letter[1]

Quito, Ecuador.

To the friends and investors of Value Investing Fund, INC.:

In our first year, ending September

1st, 2020, the fund has generated 86.48% in profits.

Ney Torres,

Portfolio Manager

Value Investing

Fund, INC.

Attachments

Here

is more information that some may find important:

Attachment

A - What you should know about the fund

Attachment

B - Statistical detail of last year

Attachment

C - Description of positions

Attachment

D - Thoughts on various issues

Attachment

E - Others

Attachment A

What you should

know about the fund

In

each annual letter, I will try to honestly assess the fund's performance,

reiterate my core investment philosophy, and share my thoughts on various

issues.

I

share some of the fund's holdings this year and explain what I think behind

each one. This way you can get a better idea of where we invest and why I

invest, how I invest, and why I am very confident about the prospects of the

fund. However, there will be times where I do not mention some positions. When

more people find these, mostly small, companies the price of the stock can move

abruptly. Nor do I mention the size of

the position.

To

entertain/educate friends, family, and investors, I have created a podcast and

a blog which you can find at neytorres.com. I hope you like it.

Performance

targets

My main objective is to obtain a compound annual

return of 10% to 15%[2],

measured in a horizon of one to three years.

It is worth mentioning two landmarks that describe the

environment today:

1. The average rate in US savings is 0.39% per year.[3]

2. “The US Stock Market Based on Historical Evidence. It

is positioned to deliver an average annualized return of -2.5%”.[4]

There will be good

years and open bad years

“In due course, great long-term performing managers

will fall to the bottom half of peer groups over multiple three- and five-year

periods. In order to generate strong long-term results, investors must stay

invested through the lulls. Moving to a passively managed strategy during

difficult periods often does not work either and switching between the two

based on trailing returns can be counterproductive. No matter what path an

investor takes, patience continues to be a prerequisite for success” -https://www.dimeoschneider.com/media/The-Next-Chapter-in-the-Active-vs-Passive-Debate.pdf

“…you

know I had spectacular returns, but I couldn’t raise any money. Because every

time I would go out and talk to people, people basically said “what the hell

are you talking about? I want a monthly, I want a two weekly; I want a weekly

return. I want you to go up in a down market. That is what I want. I want to be

the bank except that I want you to yield better… Is not how much money I lost,

is how much money I ‘forgot’” - Greenwald Li Lu CBS 2006, reflecting on

mistakes of omission because he missed big winners trying to please investors

that were asking for this.

This fund focuses on long term absolute returns. In my

opinion, it makes it less risky even if in the future it turns out to be more

volatile.

Most of the

results of any fund come from a few decisions [5]

Winners tend to keep

winning, Google is successful in part because it has cheap capital, and it has

cheap capital because it is successful, it attracts the best talent, etc.

In capitalism and life

in general, wealth, power, fame accumulates only for a few. The same happens in

investments.

One conclusion from

that is that not all our ideas will work and at any given time our gains or

losses will surely depend on a few positions, while most do not have much

movement.

We will not be

oblivious to dips of 30% to 50% at times. Nor any other fund either. It is the

nature of the stock market.

“ Even those long-term shareholders

who were rewarded with the greatest cumulative returns endured large price

declines over shorter intervals. I study shareholder wealth creation for all

publicly-listed U.S. common stocks during each of the seven decades since 1950.

Focusing on the 100 most successful stock/decades in terms of shareholder

wealth creation, I document even within the highly successful decade,

shareholders experienced draw-downs that lasted an average of 10 months and

involved an average loss of 32.5%. During the immediately preceding decade, draw-downs for these

highly successful stocks lasted an average of 22 months and involved an average

cumulative loss of 51.6%.” - https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3657604

“…I guess no one will be too surprised

that even the big winners deliver something of a bumpy ride – what surprised me

was the extent. Apple has delivered drawdowns over 70% three separate

times! Even if one today purchased a stock that will turn out to be the

big winner over the next decade or two, most likely there would be periods

where the value drops 50% or more. And, as the fourth report in the series

shows, it is very hard to

identify tomorrow's winners based on characteristics that are objectively

observable today.”

What does the fund do?

We value public companies around the world to buy

their shares, and when we are convinced that we have found something at a

discount, we invest.

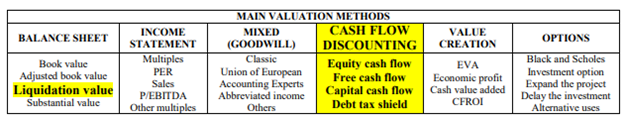

Business valuation methods can be classified into six

groups:

MAIN VALUATION

METHODS [6]

My beliefs about the fund and investing:

·

Price is what you pay, and Value is what you get. They are not the same.

If you think about it, the market is a place where there is a discrepancy in

valuation, but a price agreement.

·

The valuation depends on many factors, perspective, time and opportunity

cost (discount rate), but in general, a company or any financial asset is worth

the money it produces and will produce in the future (cash flow discounted to

present value).

·

The market is extremely efficient, so it takes a different perspective

than most to have an advantage. Ours is patience, everyone wants to get rich

quick. Our variant perspective is to go against what human nature dictates.

Contrarian investors.

·

“Successful investing is about managing risk, not avoiding it.” —

Benjamin Graham

·

Risk is not volatility, we like volatility. Risk is the permanent loss

of capital by not knowing what you are doing.

·

There is no single strategy or valuation method. Which one the fund uses

depends a lot on recognizing the market we are in. However, most of the time, I

hope we will invest in things that we are happy to have positions in for three

to ten years.

·

The size of the position is a determining factor in both trading and

long-term investments. The more conviction you have, the more we should focus.

·

If we lose money going through the vicissitudes of life, do not doubt

that it is 100% my responsibility. And that most of my assets are in the fund,

so is within my best interest to avoid this at all cost. The further we

advance, the more zeros our errors will have.

·

In the stock market, I do not compete against others, rather than

compete with myself and my belief system.

·

My motivation to run the fund is to be able to serve those who entrust

their savings to me, including family and friends.

Attachment B

Statistical

details of last year

Attachment C

Description of positions

Below, I show some of our positions and their

investment thesis. I want to clarify that these are summaries. Generally, an

investment thesis is anything but easy, but I can try to simplify them here.

Context

regarding investments in gold and silver

The

first time I started thinking about gold and silver as an investment was

probably in 2006 when I read a book by Mike Maloney which became a best-selling

book on how to invest in gold and silver worldwide to this day. As you can see,

I have spent some time thinking about this. As a value investor, I have

resisted investing in gold and silver for the simple fact that there is no

clear way to value precious metals. How do you value something that produces

nothing?

A

more rudimentary way is to look at trends and compare the purchasing power of

gold and silver with other things. We stop measuring one oz of gold against

dollars and compare it to cows, barrels of oil, etc. However, I do not know any

way to anticipate trends, when they start, when they end.

I had

to think long and hard before investing part of the fund in metal-related

stocks. By the way, we have an interview with Mike Maloney and mining experts on

the Financially Free Podcast at FinanciallyFreePodcast.com. Mike came to

Ecuador to an event that I organized with more than 700 people, and he did it

without charging a single cent. Without a doubt one of the best people I know.

If you want to understand more about gold and silver, do not hesitate to visit

their page GoldSilver.com and please see all their videos on Youtube.com

What

is the problem with investing in gold and silver?

Bottom

line: That you can go decades without a satisfactory return.

However,

what I can tell you is this:

"You don’t need to know a man’s weight to know that he’s fat” - Benjamín Graham

Note: This is a graph comparing dollar production versus

gold and silver production. But this is just US dollar printing versus GLOBAL

gold and silver production.

The premise for those who invest in gold, silver (and

even Bitcoin) is simple; we have a limited quantity, and other people will want

it in the future.

Investing in gold and silver is insurance against the

eminent fall in the purchasing power of the dollar or world currencies. They

are designed that way, an extended explanation in the next Attachment. The

image you are seeing above is a comparison between the "production"

of gold and silver versus the "production" of dollars. Every month 120

billion dollars are printed, and we only refine the equivalent of $13.6 billion

in gold and $1.27 billion in silver. We can conclude that there will be more

and more dollars fighting for a limited amount of gold and silver.

When we decide to exit our positions, depends

fundamentally on the opportunity cost of some other investment available at

that time.

Would you rather invest in a business that can grow 2,

10 or 100 times? Of course, we all know the answer to that. The economy is down

globally and as businesses crash everywhere, we can sleep like babies knowing

that our positions in these metals are probably farther from Covid-19 consequences

than most businesses. The dollar is losing its value, unlike gold and silver. Many

will think that this is true of anything that is measured against US dollars,

and they are right. But gold and silver are what people historically run to when

they are afraid.

Could the price of gold and silver drop with the Covid-19

vaccine? Yes, but only momentarily.

Source: https://goldprice.com/gold-silver-ratio/#:~:text=What%20is%20the%20Gold%2FSilver,buy%20one%20ounce%20of%20gold.

Here we can see a metric when we divide the price of

gold and silver, we can see that the result is 81. For 1 oz of gold, you can

buy 81 oz of silver. Historically this should reach 17.5. Which means one of two

things, silver is going to go up a lot, or gold is going to fall.

Our analysis indicates that silver is going to go up a

lot. We consume silver in electronic systems, cell phones, computers, etc.

People who invest in gold and silver generally point

to the monetary history of mankind. There is a predictable pattern. Governments

started with gold and silver as money, later they started creating paper notes,

trust is lost when the economy is down. These notes turn to gold and silver

once again. There has been fiat[7]

currency many times in history, they never last for long.

What is the problem?

The problem is that this is exactly the argument that

Warren Buffett's father made perhaps 80 years ago[8].

I think he was right. I think many will die being right, without seeing the

price of gold skyrocket or an economic catastrophe of such magnitude that the

dollar is destroyed or returns to the gold standard. But if Buffett had taken

the $100,000 from his initial partnership in 1956, he could have bought 2,858 oz

of gold. With an approximate current value of $5.5 million instead of his current

net worth estimated at $80.5 billion, of which he has donated the majority to

charities.

Gold is not a bad investment, particularly at the

moment, but we are not investing only in metals. We are investing in special

situations where we are going to make money if the price of gold is stable,

rises or even falls a little.

GoldX Mining

Corp (GLDX)

- Mines are the worst

business in the world, so pay attention as this fall into the category of

"special situation".

- Why are we seeing

this opportunity? Because it is small, but I hope not for long.

- Investors tend to

hate mining stocks. The value is not obvious unless you develop knowledge in a

niche.

- They have

approximately 10 million oz of gold, with a net present value of a billion US

dollars.

- This is not an

exploration mine, here the reserves are confirmed.

- "... Again,

there is a level of risk you have to take here, but the real bank for your

money is investing in a developer that hasn't gone into production yet because

you will get a reassessment when it goes into production, and also they want to

choose a developer who has the opportunity to increase their resource ounces. ”[9]-

Frank Giustra (A billionaire who made his fortune in mining and leads this

project)

Gran Colombia Gold Q1 2020

Results Webcast

In this graph, you can see that with an average

revaluation GoldX will probably see a rise of 300% to 600% of its current stock

price and this is if the price of gold doesn’t continue to rise. It may take a

few years, but there is no rush we can wait. In fact, that is our only

advantage, we are willing to have a long-term perspective.

Gran

Colombia GOLD (GCM:TSX)

Capitalization is $432 million of which 50% in cash and produces $149 million

a year. All this if the price of gold does not rise.

Freddie MAC (FMCC) and FANNIE MAE (FNMA)

These

are two banks who were affected greatly by the 2008 recession. The

simplification of the investment thesis is; that the banks have already paid

all its debts to the government. Politicians do not want to return the banks to

its shareholders, in effect nationalizing both which isn’t legal. Trump gave

hints of ending this, which may have revalued his shares by 1000%. We lost 30%

on these positions when we sold them. I believe the chance of the Democrats

winning the 2020 election is present. Therefore,

there would not be so much political force willing to fight for the

shareholders of Freddie and Fannie. Although they may surprise us any day.

Lumber Liquidators (LL)

Before the pandemic, we had a good

percentage dedicated to LL that fluctuated around $10. We sold these positions

at a small profit, as my impression of management began to deteriorate.

There were a couple of offers for the

company around $10.

Covid-19 happened, and we bought at

exactly $4. In a matter of weeks, it reached the previous price of $10. The

reason for selling was that their official reports mentioned great online

sales. When I tried to visit their website it was down for several days. I did

not think twice about selling the stock. And what happened next? The price raised

to over $28… Your humble servant did it again!

Many people argue that LL is going to

fail, for various reasons, but it certainly has the potential to be a great

company in a very fragmented and competitive market, as it once was. This

company goes to the “too hard” drawer in the world of Covid-19.

Wells Fargo (WFC)

It has been called the most hated company on Wall

Street, it has had several scandals in the last 5 years, but they are all

manageable in my opinion. The best metric for a bank is its price compared to

its tangible book value. Historically, WFC has traded at 1.4 times. In 2015 it

traded at 2 times tangible book value, more than JPMorgan, Citigroup, and Bank

of America.

Now it is trading at 0.6 times its tangible value. If

you see the projected cash flow, the price today should be $85 per share, not

$23. Wells Fargo has a lot of problems that they still need to solve such as

pushing its sales team to the point where they were opening fraudulent accounts

for their customers, very high operating expenses, low margins versus the

competition and exposure to commercial loans. Do not forget the avalanche of

mortgage defaults that are coming soon.

WFC has capitalized quite well for what is to come.

Banks make money from their deposits, and with all

these problems not only have deposits remained, but they have grown. Today WFC

has 1.4 trillion US dollars in deposits.

And while our investments in precious metals benefit

from a low-interest-rate environment, the bank does not. When interest rates

start to rise in years to come, banks will begin to expand.

Tankers

This industry is

incredibly hated and for good reason, it has been a lousy business for a

decade.

They are

beginning to enter a cycle where their earnings can go up substantially, with

some trading at 33% of their tangible book value. That is if they close doors

today and sell everything, our return would be 300%. I think that the tanker

sector, hated today and at a price that reflects it, is going to give us good

surprises in the next 2 years.

Others

Other stocks are

not of significance now and have been ‘frozen’ with no profit or loss. The

closed ones are; 869 Playmates toys limited, TLFA,

PSH, LFE and LPG. In general, we closed these positions to focus on others with

greater profit potential, considering new information. In none of them, we made

or lost substantial amounts.

Vertu Motors PLC (VTU)

Vertu Motors PLC

is a car retailer in the UK. A business with stable margins. About 75% of the

company's profits come from recurring service revenue and used car sales

combined.

It allows us to

have exposure to the British pound (GBP). It has more than 100 concessionaires

and owns half of the properties.

With a return of

11.73% on tangible equity in the last decade, buying those £44 of tangible book

value per share at just £26 is a 40% discount. Our long-term return would go

from 11.73% to 16.42% annually.

In the long term,

we expect to see a return on investment of 16.42% annualized for having these shares,

and they can double in the not so distant future.

There is a stock

that is responsible for 27.4% of this year's earnings and that I expect to go

up 500% more. However, it is so small that the price can move easily, so we

will keep it hidden until we sell it.

ProShares Ultra

Pro S&P 500 ETF (UPRO) and Direxion Daily S&P 500 Bull 3x Shares ETF

(SPXL)

We

took positions in these funds when the market fell. A lot of this year's

returns come from these two funds, and options we invested in.

More

about these two positions in the Financially Free Podcast, episode 31:

https://www.youtube.com/watch?v=4TZHlCyAuvw

or

https://financiallyfreepodcast.libsyn.com/31-50-a-year-guarantee-buffett-challenge-with-ney-torres

Initially, the positions in UPRO and SPXL grew

to represent more than 40% of the portfolio. They were positions we took when

the market crashed and the central bank declared that it was going to enter the

markets (manipulate them). Even if they had to buy the stocks and bonds

themselves.

I hypothesised that they were going to do

their best to reach levels from before the US elections and that is exactly

what happened. About 25% of the return this year was thanks to these positions.

While the implied volatility of the

options of these two funds stabilized (this means that they were very expensive

before) we changed our positions to two-year options (also called “leaps”) this

way we lowered our exposure to only 10% of the fund. These options were up

180%, representing about another 14% of our return of 84% this year.

We sold these “Leaps” because I believe the markets

are expensive right now and it can

take a long time to get your money back if you happen to invest on the top of a

cycle. Here is the Nasdaq, it took about 14 years to recover. This is not

market timing we just simply have better ideas.

Source:

https://www.macrotrends.net/1320/nasdaq-historical-chart

How do we know if the market is overvalued?

I do not know. But let me repeat:

"You don’t need to know a man’s weight to know that he’s fat” - Benjamín Graham

The metric that I like to use to

evaluate the market, in general, is price/sales. The Economist John Hussman has

shown that this metric is the one with the highest negative correlation with

respect to the returns of the market for the next 10 years.

That simply means that when price/sales are

high, the returns for the next 10 years are low, and vice versa.

A similar metric to the

one stated above replaces "price" with "market

capitalization" and "sales" with "GDP" how much a

country produces in a year.

This “Market Cap / GDP”

metric is also known as the “Buffett indicator” because Warren Buffett mentioned

that it is the best rule of thumb to assess whether a market is overvalued or

not.

“As of 2020-09-26

03:05:05 PM CDT (daily updates):

The stock market is

significantly overvalued. Based on the historical ratio of total market capitalization

to GDP (currently 173.5%), it is likely that you will get a return of -2.5% per

year from this valuation level, including dividends.” - https://www.gurufocus.com/stock-market-valuations.php

"2021 to detonate an avalanche of business insolvency"

The year 2021 is coming

and it is going to be anything but boring.

Attachment D

Thoughts on various matters

This

section is written to explain some important concepts.

Every

year I hope to write and explain a different topic.

I

saw this headline a week before writing this report:

“$92,033 - The average salary for a

Harvard University graduate 10 years after graduation. Harvard ranked at the

top of the Wall Street Journal's annual list of college rankings.” - Wall

Street Journal

Congratulations! You

just graduated from Harvard, it is a big 4-year endeavor and costs between

$47,000 to $78,000 annually[10]. You are certainly a lucky person, there are only 371,000[11] graduate students from the best university in the world. On a planet of

almost 8 billion people[12], where 50% is estimated to live on less than $5.50 a day (in 2018) and

10% lives on less than $1.90 a day[13].

Now you work 5 days a

week from 9 am to 5 pm, and probably more, to earn $92,033 annually. After

taxes you take home $56,267.76, assuming you do not pay any state or city

taxes. If your partner earned the same, you both would be among the top 5 to 10%

of the highest income in the USA, the richest country in the world. If your job

is in California or New York, for example, you would have to pay more than 50%

in taxes. In theory, all the money you earned from January to June went

directly to the government. Did I mention that your rent is more than $3000 for

a normal apartment? ... But in this example let us forget about all this. I am

going to let Harvard graduates take the lead, forget about the high rents and state

or city taxes. Let us imagine that they live with the same salary in another

country, doing remote work on the beach perhaps?

Now, what would have

happened if that student had invested the average annual cost of attending

Harvard ($62,500) and had invested it at 17.41% annually? You guessed it! A

$56,267.76 yield in the fifth year, as seen in the table below. The same amount

as you would have taken home in the form of a check, and with fewer taxes

because earned income is taxed quite different than investment income.

So by investing, after

four years you would make the equivalent of an average Harvard graduate with a full-time

job who also paid a fortune on tuition and spend four years of their life at

the best university in the world (assuming you don't pay state and other taxes

that are automatically deducted from your salary).

But unlike the

university graduate, the investor doubles his capital every 4 years.

This is not a criticism

towards Harvard students a quality education fulfils many more goals in life

than simply making more money. But this is the financial reality that I was

faced to see a couple of years ago when I was applying to Stanford in

California (I'm not saying they would have accepted me by the way).

I do this simple

exercise to highlight the power of compound interest and the advantages of

independent thinking. That is what this fund is trying to do for its investors

and me.

It has taken me 15

years to start this small fund and 15 years to understand how to compete

against Wall Street and the secret is... patience.

Why 15 years? Because I was trying to create enough capital to start, but life goes up and down, turns and gives you surprises. Now I understand that I should have just started 15 years ago and focused even with $10,000.The problem is that we are always in negotiation with ourselves, waiting for something important to happen; "if I only sell this property", "if I get this credit", "if they accept this offer", "after the next raise", "if I liquidate inventory ”… then I can be calm and invest. Next thing you know,15 years have passed. This is the catch; investing is more like a dropper than the allocation of big chunks of capital. If in those 15 years anyone that had saved $ 326.15 per month and invested at the same rate as our imaginary Harvard student, they could have achieved the same result.

If for a moment you

thought this exercise did not apply to you because you did not have rich

parents to pay for Harvard, you do not have an excuse either. You just had to

start investing small amounts earlier.

Plus “Harvard

University” is a metaphor that represents any financial goal you have like retirement

or legacy.

I want to use these

annual letters to explain what has taken me so long to learn. Hopefully, I can

make it easy and entertaining. If you can sit down and read the following pages

you will understand the world and the future a little better. Enjoy!

Ok, let’s make money

investing! For that we first need to understand:

How does the economy work?

(An easy explanation)

Every time you buy or

sell something, you have just made a transaction "the economy",

"the market", is the sum of all these transactions.

Each transaction is the

exchange of money or credit for goods, services or financial assets.

If we add all the

credit that we use plus the money that is spent, we have the total

expense.

Money + credit = Total Expense (the sum of goods, services, or financial

assets)

So far nothing

difficult to understand. Right?

Total spending is what drives

the economy (at least in economic theory):

Total

expenditure / total quantity (of goods, services, financial assets) = Price

or

Total

Expense / Things we want = Price

That is a transaction,

so far, I have not described anything new, only described what seems obvious.

But! If you can

understand how transactions work, you can understand the economy and where it

is going (you can see the future!)

What is a “market”?[14]

A series of transactions

of some kind.

Example: car

transactions. We call this the “Car Market”. Transactions in sugar, the “Sugar

Market”. Etc.

Today we will focus on

the Stock Market.

Who is the

biggest buyer and seller in a market?

The Government! In the

US[15] and many other countries this government consists of two main parts:

1.

The “Central Government” who is responsible for spending

the money and

2.

The “Central Bank” that controls the flow of money,

important to control the economy and does it in two ways:

1) raise and lower

interest rates

2) print money

The

least understood part of the economy is CREDIT

Do you want something

you cannot afford? A good, a service or a financial asset? To start a business

or buy a house you need credit!

If credit is cheap,

more people get into debt.

Whoever lends has just

created an asset and receives interest, and whoever receives the money now has

a debt and pays that interest.

Note: Credit can be

created by two ordinary people out of thin air! As you surely understand,

everything depends on trust, when trust between humans disappears, the system

begins to break down.

When debt is spent it

becomes someone else's income, and this, ladies and gentlemen, is what drives

the economy.

It is much easier to go

into debt for 100,000, 1 million, 2 million, 100 million dollars than to earn

it by selling something. That is why it is so important to understand credit!

What do you need to

access credits?

1) Being able to pay it

2) A guarantee

Why does the

market go up and down so abruptly?

The higher your income,

the greater your ability to pay a debt. The more debt, the more spending, the

more income for someone else, this effect is multiplied through society and the

economy begins to produce more things, more goods, more services and more

financial assets.

We call this productivity,

and it is easy to predict in the long term.

Productivity:

Source: https://www.researchgate.net/figure/Real-US-GDP-per-capita-1870-2006_fig1_46457345

When investing we try

to forget about the short-term fluctuations, as much as possible and focus on

what is predictable and knowledgeable. You guessed it! Productivity.

What is this

“productivity”?

Productivity is that we

get better at creating things with time (the knowledge and things that help us

to produce these goods and services is also called technology).

Technology helps us make life more pleasant and bearable. Now you have more things

to improve your standard of living than 200 years ago. Only 20 years ago the

best way to communicate with my parents from another continent was a “long

distant call” (expensive) or letter (slow). Today I can have video

conversations through a cellphone with anyone on the planet basically for free.

We can access the

brightest minds and ideas on the planet from any cellphone or computer. (Now

...if most people prefer to be distracted by watching Netflix instead of

improving their productivity, there is not much you and I can do about it, I

guess our job gets easier for lack of competition).

Those who work hard and

improve their productivity every day increase their standard of living faster

than those who indulge easily.

When someone becomes

innovative, they can create something better or cheaper. This creates

inequality. If you ever think that life is unfair, I hope you know that it is

true, but that the best way out of it is to innovate. That is the time that you

want to create something new or different that others appreciate.

But not everything is as

obvious as trying harder, doing more and doing better! Long-term productivity

is easy to determine, but there is a trap that allows people and governments to

steal from the future to feel rich today and produce more… momentarily: DEBT!

Why debt is

stealing yourself from the future?

Because debt is a

promise to take my productivity (from the future) to pay interest ... in the

future.

What creates abrupt

rises and falls in any market is debt and this exists in two large cycles, one

of 5 to 8 years, and another of 75 to 100 years.

Below you will find a

graph of gross domestic product growth (all the things a country produces in a

year) versus time. It is a very rudimentary way of measuring the average

standard of living of human beings. Assuming that the more variety of things we

create or produce, the better the standard of living[16]. Do you have a rare disease? The more specialized and productive

society is, the greater the possibility that you can get cured, and the cheaper

it is.

Source:

https://getmoneyrich.com/economy-and-short-term-debt-cycles/

Now that you understand

this:

•

You know that every decade, the world “breaks” for some reason at least

once every seven to ten years because of the “short debt cycle”.

•

When there are problems, everything that was built in decades falls out

the window in a period of two to three years into a "Depression", but

productivity continues its slow path, which leads us to have a better standard

of living in the future (that's why I'm optimistic but only in the long term).

•

In those couple of years (depression) it is the best time to buy at a

discount, this includes financial assets. It is precisely when there is greater

uncertainty that you must invest. When most people say, "let's wait to see

what happens" (example political elections). Uncertainty is and will

always be our ally.

•

The general problem is having cash or credit at the moment when

everything is at a discount. When you have done your previous work well and

have this cash or credit the decisions are obvious.

•

This cycle is predictable

•

What you must do throughout your life is specialize, be more productive

in something that others want or need despite short term fluctuations.

•

Stop watching so much Netflix / TV!

Credit

versus Money

Credit is about 15

times bigger than cash (in US dollars).

Money is the only thing

that consolidates or pays a debt.

Therefore, the system

is made to constantly generate more debt (due to interest). If we tried to pay

all debt the system would "break", it would stop working. The name of

the game, therefore, is "good debt".

Debt is good if it is

invested efficiently.

Debt is bad if it is

spent or inefficiently placed on non-productive things. The wealth you have

saved in the past (savings) or “stolen” from the future (debt) is destroyed.

Placing money

efficiently is what an investor does! That is what I do and what I specialized

in for 15 years! It is what makes me productive in this society

Note: The best two

hours invested in your financial life is probably watching the series created

by Mike Maloney on his YouTube channel called "Hidden Secrets of Money”.

Here Mike takes an extremely complicated topic like the history of money and shows

how it works in easy to understand videos with animations. Like a short documentary.

Why

do you have to work?

The question seems silly. The answer? Because you have

expenses!

Next question: What is the biggest expense in your

life?

This answer is not so easy because it varies depending

on your level of productivity.

Some may think “food $ ____, mortgage / rent $ ___,

insurance $ _____etc.”

But the more productive you are, the clearer the tax

issue becomes.

Imagine you made $1 million this year. The median tax

rate for taxpayers making more than $1,000,000 is 33.1%... That is $331,000

Let's exaggerate, imagine you made $10 Million this

year. There is no way you can spend 33.1%[17] of that on food,

education, etc.

But there is a tax that you are paying right now, in

the same proportion as the millionaires and the poor. It is an invisible tax…

and there is nothing you can do to avoid it except invest. This ‘invisible tax’

is called inflation!

Inflation

What this chart shows

is that, depending on how you measure it, you lose between 4% to 6%[18] value on your money annually. You can buy 4-6% less with the same

amount of money. How much did your bank pay you this year? Ha!

If 4% per year does not

scare you, it is because you have not thought about the long-term compounding

effect that this has on your savings and your income:

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

|

$10.000 |

$9.600 |

$9.216 |

$8.847 |

$8.493 |

$8.153 |

$7.827 |

$7.514 |

$7.213 |

$6.925 |

An inflation of 4% is

like having a compound annual expense of 4%. This includes your salary, rent,

savings etc.

I am not going to make

a graph with 6% real inflation, so you don’t stress out.

Inflation forces you to

work and invest. If you don’t your savings will be worth even less and less and

your income too! That is why every time you must work harder, be more

productive or be innovative.

Inflation passes wealth

from your pocket to the central government, magically.

In our system, the

politician the most popular politicians win elections. To be popular they

usually promise more things. The government makes more promises and prints more

money to pay for all these promises. The value of the money that politicians

use comes at a cost, collection of taxes and the devaluation of your savings.

Every time there is a war, you pay, every time the market crashes and the

government jump’s in to save the companies that are “too big to fail”, you pay!

You just do not realize it immediately. Unfair? Completely. But the question is:

what are you going to do?

In 1960 the average

salary in the USA was enough for a person with a normal job to have a house, a

car and be able to support his partner and children without any problem. Today two

middle-class jobs hardly allow you to survive. Sadly, if you do not invest, you

will not get ahead, plain and simple.

Deflation

Deflation is the

opposite of inflation. The price of things begin to fall, therefore, your money

can buy you more!

Economists avoid

deflation in all possible ways, because when the price of things fall: There

are no longer profits, there are layoffs, companies begin to fail, and the

system begins to fall under its weight. Eventually, there are mass

demonstrations and the most radical candidate who promises to solve everything

is generally elected, for example, Hitler!

The objective of a

central bank is generally to have low inflation. This is easier said than done.

When there is a lot of

debt the government tries to stop inflation by raising interest rates. For them,

it is like applying a brake. By the way, the brake is quite effective.

When they want the economy

to accelerate, they lower interest rates (this is like pressing the gas), so

that people get into debt and there are more transactions, and the economy is

activated.

The market is very

intelligent, so economists know that if they want to have a noticeable impact,

they must surprise the public. That is why generally when interest rates rise

it is done suddenly, but they can’t alert anyone if the markets expect a rise

in these rates, prices are quickly rectified. Many times, government

authorities bluff to obtain their objectives, sometimes that is all it takes,

they do not even have to raise or lower rates, only to suggest that they could

do it can move the market.

Market participants,

millions of people, adapt and anticipate any stimulus.

Therefore, the monetary

policy game is so difficult and not just a mathematical formula. I do not know

anyone who can predict interest rates to consistently make money.

"We've long felt that the only value of stock

forecasters is to make fortune tellers look good.". - Warren Buffett

Politicians,

they don't know what they are doing!

Ha! I always hear this.

Those who say it do not understand that even the politician’s hands are tied,

they are part of a much larger, predictable machine.

If you understand this,

you will be able to see the future much better than the average person, so pay

attention!

When an economy gets

into trouble there are only 4 things you can do:

1.

Cut expenses (business and government)

2.

Reduce debt (forgive or restructure)

3.

Redistribute wealth from the rich to the poor (do you want more taxes?)

4.

Print money (Countries like Ecuador do not have this option because at

some point in their history they did it so much that their currency was

destroyed and started using the US dollar)

Cutting expenses, reducing

debt and redistributing wealth through taxes create more depression.

Whereas printing money

is easy and creates inflation (and a false sense of progress at first).

If governments can

balance their inflationary efforts with deflationary ones, that is, if all

their efforts to activate the economy equal all the force that is destroying

the economy, a recession is quite bearable. Since inflation would not be a

problem, there is real economic growth and debts decrease with respect to

income, all good, even though we are on the decline. But wealth will pass from

one part of the population to another. Which side are you on?

A final

note, given the business closures and the difficulties we are going through.

Without a doubt, as an

entrepreneur I understand very well what it feels like to go bankrupt. To close

a business, lay-off staff and have debts. It has happened to me a couple of

times in my life. Capitalism and life can be brutal. When you read that a

company goes bankrupt, remember what it means is that the company now has new

owners. What technology, pandemics and recessions do is to reorganize us as

humans into new perspectives, new projects, new professions.

“History

doesn’t often repeat itself, but it often rhymes” - Mark Twain

Last century humanity

went through 10 pandemics[19], the worst was in 1918 with the Spanish flu that killed 3-5% of the

world's population. Humanity went through many wars of which two world wars[20]. In 13 occasions there was almost a nuclear attack and yet the world

production went from $3.42 trillion in 1900 to $60 trillion in 1999. In one

lifetime humanity prospered 20 times more despite all these difficulties.

Although "life

does not wait for anyone", you shouldn’t doubt that the best is yet to

come. "Waiting for things to settle down" (whatever that means) is an

awfully bad idea. The future is always uncertain. The most recent events tend

to occupy more relevance in our mind and it always seems that “now is

different”.

In the stock market,

you must invest especially when there is uncertainty because when there is no

uncertainty there is optimism. That optimism drives up the stock price, and the

more you pay for a stock, the lower your return.

“Buy when

there's blood in the streets, even if the blood is your own.” - Baron

Rothschild[21]

This

last sentence shows that when investing, IQ doesn’t matter as much as the

temperament and character.

“Investing is not a game where

the guy with the 160 IQ beats the guy with the 130

IQ. Once you have ordinary intelligence, what you need is the temperament

to control the urges that get other people into trouble in

investing.”. – Warren Buffet[22]

Covid-19

I think we all know

people who are no longer with us because of Covid-19, if you are reading this,

you are among the lucky ones. I want to end this year with condolences to those

who have lost a loved one in this pandemic.

Attachment E

Other notes

FinanciallyFreePodcast.com

Episode 31) 50% a year

guarantee Buffett challenge with Ney Torres

From

the famous quote:

“If I was running $1

million today, or $10 million for that matter, I’d be fully invested. Anyone

who says that size does not hurt investment performance is selling. The highest

rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You

ought to see the numbers. But I was investing peanuts then. It’s a huge

structural advantage not to have a lot of money. I think I could make you 50% a

year on $1 million. No, I know I could. I guarantee that.”- Warren Buffett

A year ago, I

got interviewed and I said that we could do this. We opened a real money

account and 9 months later we reached our goal. In this episode, Veerle van den

Berg interviews me on how it was done.

Episode 21) Mary Buffett:

Value investing and stories about Warren Buffett.

In this episode we talk

with the charming Mary Buffett on her stories on value investing, and how she

found out that her father-in-law was becoming the best investor in history. She

is so kind, really an outstanding person.

Episode 10) The Best Trading

Coach in the World - Van Tharp

An interview with who I

consider the best trading coach in the world because he has focused more than

anyone on psychology in trading for decades. An incredible career, one of the

best minds on trading in the world.

Episode 29) Brad Sugars

on Financial freedom, buying businesses without your own money

Don’t miss our talk with

business coach Brad Sugars. He is the pioneer in the business coaching industry,

he created the first successful business coaching company “Action Coach” with

over 1000 offices around the world.

Chuck Norris wishes Ney Torres a happy 37th

birthday! (Special

episode October 11th,2020)

Special thanks

to:

Doctor Veerle Van den Berg, for helping me edit the English

report for hours and hours, obviously my native language is Spanish. She has a

sharp mind, never stops to amaze me how smart she is.

Legal

information and disclosures

This

letter does not constitute, and should not be construed as, an offer of

advisory services, securities or other financial instruments, a solicitation of

an offer to buy any security or other financial instrument, or a recommendation

to buy, hold or sell a security or other financial instruments in any

jurisdiction.

The

provision of information in this letter does not constitute the provision of

investment, consulting, legal, accounting, tax or other advice.

The

information presented in this letter reflects the current views of the author

as of the date of the letter. As facts and circumstances change, the views of

the author may also change. This letter may include forward-looking statements.

These forward-looking statements involve known and unknown risks,

uncertainties, assumptions, and other factors that may cause actual results,

performance or achievements to be materially different from the future results,

performance or achievements expressed or implied in such forward-looking

statements. Also, new risks and uncertainties may arise from time to time.

Accordingly, all forward-looking statements should be evaluated with their

inherent uncertainty in mind. The Fund does not undertake any obligation to

update this letter.

PAST

PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS, WHICH MAY VARY.

Certain

information contained in this letter, such as market and economic information,

is obtained from third party sources and may not be updated until the date of

the letter. While such Sources are believed to be reliable, the Fund assumes no

responsibility for the accuracy or completeness of such information.

[1] Value

Investing Fund, INC is a corporation incorporated under the laws of Florida, on

September 1, 2019. I do the closing date, but I hope to publish the report

until October 11 of each year.

[2] It may not look like much but a 15% compounded

interest rate would growth your capital 400% in 10 years

[4] Gurufocus - https://www.gurufocus.com/stock-market-valuations.php “Los mercados no prometen

ganancias pronto. Con base en la relación histórica de capitalización de

mercado total sobre el PIB (actualmente en 173,5%), es probable que obtenga un

rendimiento de -2,5% anual incluidos los dividendos” Gurufocus - https://www.gurufocus.com/stock-market-valuations.php

[5] https://www.jpmorgan.com/cm/BlobServer/Eye_on_the_Market_September_2014_-_Executive_Summary.pdf?blobkey=id&blobwhere=1320684901654&blobheader=application/pdf&blobheadername1=Cache-Control&blobheadervalue1=private&blobcol=urldata&blobtable=MungoBlobs

[6] https://poseidon01.ssrn.com/delivery.php?ID=440117105065027124110114085116122122061052048060033049127111011125116107064019025074050061056028053034110065023010064127027124098041043075040104065104073095066009034071111004002078095031125119020118011126025126086007026000007115071126021093018094&EXT=pdf

[7] Fiat money is

government-issued currency that is not backed by a physical

commodity, such as gold or silver, but rather by the government that issued it.

- investopidia

[8] The Snowball: Warren Buffett and the Business of Life Book by Alice Schroeder

[9] Get Gold as Cash and Bonds Will

Be Destroyed Warns Billionaire Frank Giustra - Stansberry Research

[10] https://www.cnbc.com/2019/04/05/it-costs-78200-to-go-to-harvardheres-what-students-actually-pay.html

[11] https://www.harvard.edu/media-relations/quick-facts#:~:text=Alumni,in%20some%20202%20other%20countries.

[12] https://www.worldometers.info/world-population/

[13] Lakner,

Mahler, Negre, Prydz, 2020. PovcalNet, Global Economic Prospects via World Bank

[15] Nota: I generally describe the US market,

because that is where we invest most of the fund, but this letter is addressed

to people in North America, Latin America, Europe. The markets work similarly

in capitalist countries

[16] Note: Many people will argue that measuring gross

domestic product is a wrong way to measure humanity's progress since material

things do not represent well-being, and it is true. But assuming that the goal

of the person's well-being is peace or happiness, the only objective way to measure

well-being is through measuring the number and type of synapses in your brain,

which is impossible now. Until then this is the best we have, and we use this

graph. If you did not understand this note read "Homo Deus by Yuval Noah

Harari"

[17] https://taxfoundation.org/how-much-do-people-pay-taxes/

[18] politicians

always try to change this to look good, they use the red line, I use the blue

line for reference

[20] https://www.iwm.org.uk/history/timeline-of-20th-and-21st-century-wars

[21]

https://www.investopedia.com/articles/financial-theory/08/contrarian-investing.asp#:~:text=Baron%20Rothschild%2C%20an%2018th%2Dcentury,streets.%22%20He%20should%20know.&text=The%20original%20quote%20is%20believed,the%20blood%20is%20your%20own.%22

[22]

https://fs.blog/2011/10/warren-buffett-on-temperament/#:~:text=%E2%80%9CInvesting%20is%20not%20a%20game,people%20into%20trouble%20in%20investing.%E2%80%9D